Tax Preparers Lobby Hard to Make IRS Forms more Complicated

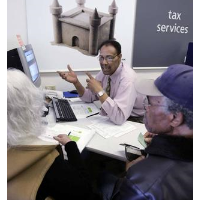

An H&R Block tax adviser meets with clients (photo: Paul Sakuma, AP)

An H&R Block tax adviser meets with clients (photo: Paul Sakuma, AP)

Wouldn’t it be nice if filing income tax forms was easier and less complicated? Americans would surely think so, but companies that make money off the difficulty of understanding the tax system hate this idea and are actually trying to make the process even tougher for people to do things themselves.

The tax preparation firm H&R Block and Intuit, maker of TurboTax, have lobbied Congress to keep the Obama administration from simplifying the filing of taxes.

In some cases, the Internal Revenue Service (IRS) could offer automatic tax filing for some taxpayers, but the idea “has gone nowhere,” according to Vox’s Dylan Matthews. H&R Block and Intuit’s lobbying are to blame for the changes not being developed and implemented, Matthews wrote.

The companies, however, have gone a step further and convinced members of the U.S. Senate to embrace a bill that would force the IRS to expand the length of the Earned Income Tax Credit (EITC) form from one page to as many as five.

“It is hard to adequately express how despicable this is,” Matthews said. “The EITC is one of America's premier anti-poverty programs. It targets poor families specifically, and because you have to work to get it, countless studies have found it encourages single mothers and other people without much connection to the labor market to enter the workforce.”

“The Census Bureau estimates that it and the related Child Tax Credit keep 9.4 million people out of poverty every year,” Matthews added, “and recent research suggests that when you take into account the people the EITC brings into the workforce, the real number is probably twice that. If that weren't enough, it also boosts test scores for kids in families receiving it and improves both parents' and children's health.”

H&R Block and Intuit want a piece of the EITC pie, so to speak, and making the form longer would force many of those who qualify for the tax break to go to tax preparers for help. And that, by the way, will result in more taxpayers overpaying taxes to the government. Such was the revelation from an IRS study (pdf) that, indeed, found that tax returns making EITC claims were more likely to result in overpayments when the returns were done by paid tax preparers.

-Noel Brinkerhoff

To Learn More:

H&R Block Snuck Language into a Senate Bill to Make Taxes More Confusing for Poor People (by Dylan Matthews, Vox)

Senate Bill Would Boost Burdens, Costs to Claim Working Family Tax Credits (by Robert Greenstein, Center on Budget and Policy Priorities)

U.S. Paid $125 Billion to Ineligible Recipients, a Jump of 18% in One Year (by Steve Straehley, AllGov)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump Orders ICE and Border Patrol to Kill More Protestors

- Trump Renames National Football League National Trump League

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

Comments