House Bill to Stop Congressional Insider Trading

Wednesday, July 08, 2009

It is illegal for anyone working on Wall Street to use non-public information to help them make investment decisions in the stock market. But the same insider trading restrictions do not apply to Congress, whose members and staffers are free to use information floating around Capitol Hill to guide decisions for their own or others’ portfolios. This huge loophole in securities law may change, however, if legislation introduced in the House becomes law.

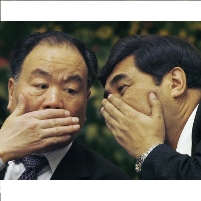

Representatives Brian Baird (D-WA) and Louise Slaughter (D-NY) have reintroduced a bill, now backed by the League of Women Voters, Common Cause and Public Citizen, that would ban lawmakers and their staffs from trading in stocks, bonds and commodities markets based on insider knowledge they’ve acquired from being in Congress. The proposal would also prohibit those on Capitol Hill from passing on such information to spouses, friends or trading firms.

Although there’s no hard evidence that lawmakers and staffers have been involved in insider trading, Baird, who first proposed the Stop Trading on Congressional Knowledge Act in 2006, told the Washington Independent it is “almost a certainty” it takes place, given that DC is a “town that trades on information.” It was also pointed out that last fall, only one day after a closed-door meeting between officials from the Federal Reserve and the Treasury Department and congressional leaders to discuss the Wall Street bailout plan, at least 10 senators traded stock or mutual funds related to the finance industry, according to disclosure forms filed by lawmakers last month.

In addition, a 2004 study published by researchers at Georgia State University showed a group of senators enjoyed investment returns 12% above the rest of the market between 1993 and 1998.

-Noel Brinkerhoff

Bill Threatens Congress’ Shield From Insider Trading Laws (by Mike Lillis, Washington Independent)

Insider-Trading Ban May Extend to Members (by Jessica Holzer, The Hill)

Abnormal Returns from the Common Stock Investments of the U.S. Senate (by Ziobrowski, Cheng, Boyd and Ziobrowshi, Journal of Financial and Quantitative Analysis) (PDF)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Donald Trump Has a Mental Health Problem and It Has a Name

- Trump Goes on Renaming Frenzy

- Trump Deports JD Vance and His Wife

- Trump Offers to Return Alaska to Russia

- Musk and Trump Fire Members of Congress

Comments