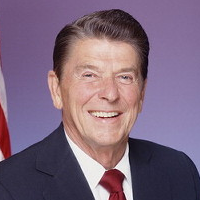

Can U.S. Repeat Reagan’s Tax Reform…Matching Income Tax and Capital Gains Tax?

When the basic thrust of the liberal and Democratic policy establishment is to revive a reform last championed by Republican president Ronald Reagan, we have surely gone through the looking glass, yet that is where the country finds itself just weeks after a decisive Democratic electoral victory. Why are Democrats, who ran on a slogan of “Forward,” rummaging about in the attic of old GOP ideas for new policy proposals?

Last accomplished in 1986, comprehensive federal income tax reform is on the table for 2013. The 1986 legislation, the Tax Reform Act of 1986, is largely credited to Reagan and to Sen. Bill Bradley (D-New Jersey), who shepherded it through Congress.

The key income tax reforms in 1986 raised the maximum tax rate on long-term capital gains to 28% from 20% while reducing the maximum rate on ordinary income to 28% from 50%. Capital gains are income arising from investments, while ordinary income arises from work. Thus the 1986 reform taxed income from work and from investment equally, ending the discrimination against work and in favor of investments that had favored the wealthy.

That discrimination was reinstated, however, as part of the 2003 George W. Bush tax cuts. Since then, the maximum rate on capital gains has been 15% while wages are taxed at a maximum rate of 35%. The effect, according to a recent study from the Center on Budget and Policy Priorities, has been to “add to budget deficits, widen income inequality, and do little if anything to promote economic growth.”

Pointing out that the top 1% of taxpayers gets 71% of all capital gains, the study argues that the regressive nature of low capital gains tax rates also renders them inefficient and detrimental to the economy as a whole. Citing a recent Congressional Research Service report—which was suppressed by Congressional Republicans who did not like its conclusions—the study concludes that low capital gains tax rates have reduced the overall buying power of American consumers and thus damaged the economy.

Given continued Republican control of the House of Representatives—albeit with their margin cut—compromise on both sides will be necessary, just as it was in 1986. By resurrecting the ghost of Ronald Reagan and his attachment to tax fairness, Democrats seem to be trying to maneuver themselves into the position of turning old Republican ideas on today’s GOP lawmakers.

-Matt Bewig

To Learn More:

Tax Reform Might Start With a Look Back to ’86 (by Floyd Norris, New York Times)

Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits (by Chye-Ching Huang and Chuck Marr, Center on Budget & Policy Priorities)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

- Donald Trump Has a Mental Health Problem and It Has a Name

- Trump Goes on Renaming Frenzy

Comments