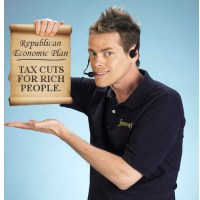

House GOP Blocks Nonpartisan Report that Debunks Tax Cut Mythology

A report by the nonpartisan Congressional Research Service (CRS) concluding that tax cuts for the wealthy have not yielded economic growth but have contributed to growing economic inequality was quashed by Republican senators unhappy with its conclusions.

The September 14 report was cited widely in the media and attacked mercilessly on the right. According to Don Stewart, spokesman for Senate Minority Leader Mitch McConnell, the Kentucky Republican and other senators “raised concerns about the methodology and other flaws,” including the report’s use of the terms “Bush tax cuts” and “tax cuts for the rich,” which Republicans complained were politically biased. Under pressure, CRS withdrew the report from circulation on September 28.

Although Stewart claimed that CRS “decided, on their own, to pull the study pending further review,” an anonymous source told the New York Times that CRS’s economics division opposed the withdrawal and that study author Thomas L. Hungerford stood by its findings. Hungerford, a public finance specialist who earned a Ph.D. in Economics at the University of Michigan in 1989, has contributed $1,250 this election cycle to President Obama’s re-election campaign, and $2,200 to a combination of Democratic campaign committees.

The report reviews data on tax rates, saving, investment, productivity, GDP and income distribution for the six decades since World War II. Since the presidency of Ronald Reagan, the Republican party has insisted, as a matter of supply-side economics orthodoxy, that tax cuts for so-called “job creators” will spur savings and investment, which will in turn cause productivity growth and a rising GDP. This argument was advanced by the Reagan administration to justify its tax cuts, and again by the George W. Bush administration in support of its rate reduction.

The report evaluates these claims by comparing them to what actually happened, and finds that they did not live up to promises made on their behalf.

“Reductions in the top tax rates have had little association with saving, investment, or productivity growth. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. . . . The evidence does not suggest necessarily a relationship between tax policy with regard to the top tax rates and the size of the economic pie, but there may be a relationship to how the economic pie is sliced.”

–Matt Bewig

Nonpartisan Tax Report Withdrawn after G.O.P. Protest (by Jonathan Weisman, New York Times)

The Nonpartisan Study on High-Income Tax Cuts the GOP Doesn’t Want You to Read (by Travis Waldron, Think Progress)

Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945 (by Thomas L. Hungerford, Congressional Research Service)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump Orders ICE and Border Patrol to Kill More Protestors

- Trump Renames National Football League National Trump League

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

Comments