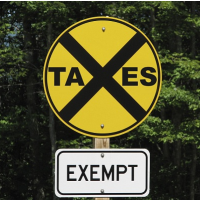

IRS Accused of Losing $100 Billion a Year by Allowing Politicized Churches to Remain Tax-Exempt

The Internal Revenue Service (IRS) has allowed churches to engage in partisan advocacy while also not enforcing nonprofit rules on them, according to a lawsuit filed by a religious freedom group.

Since 1954, the IRS has prohibited tax-exempt organizations, including churches, from publicly supporting election campaigns. The IRS enforced the law under Presidents Bill Clinton and George W. Bush, however since Barack Obama became president, the IRS has stopped enforcement.

In its civil complaint, the Freedom From Religion Foundation claims the IRS is failing to collect $100 billion a year by permitting churches to maintain tax-exempt status, even though many are violating rules that prohibit tax-exempt entities from engaging in electioneering speech.

The foundation has complained numerous times to the IRS about alleged violations of the Establishment Clause in the U.S. Constitution. These violations include Catholic Bishop Robert Morlino of Madison, Wisconsin, telling followers they cannot “in good conscience” support pro-choice candidates for office.

Another bishop, Daniel Jenky in Peoria, Illinois, compared President Barack Obama to Adolph Hitler and Joseph Stalin during a homily delivered at his cathedral. The foundation also called attention to the actions of Rev. Billy Graham, who took out an ad in The Wall Street Journal and other periodicals urging his followers to vote for candidates who opposed abortion and same-sex marriage.

In October hundreds of pastors taunted the IRS by speaking in favor of candidates as part of Pulpit Freedom Sunday.

The Freedom From Religion Foundation wants the court to order the IRS to enforce electioneering restrictions against churches and religious organizations, and it wants injunctions against any churches or religious organizations violating the restrictions.

-Noel Brinkerhoff, David Wallechinsky

To Learn More:

IRS Gives Partisan Churches a Pass, Group Says (by Lisa Buchmeier, Courthouse News Service)

Is the IRS Failing to Uphold the Separation of Church and State? (by Steve Williams, Care 2)

Freedom From Religion Foundation v. IRS (U.S. District Court, Western District of Wisconsin) (pdf)

Pastors Prepare to Taunt IRS by Endorsing Candidates Despite Tax-Exempt Status (by Noel Brinkerhoff and David Wallechinsky, AllGov)

IRS Balks at Investigating Tax-Exempt Organizations Accused of Violating Tax Laws (by Noel Brinkerhoff, AllGov)

Tax-Exempt Churches Plan to Engage in Illegal Electioneering (by Matt Bewig, AllGov)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump Orders ICE and Border Patrol to Kill More Protestors

- Trump Renames National Football League National Trump League

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

Comments