Banks Earned $13 Billion from Secret Government Loans

Tuesday, November 29, 2011

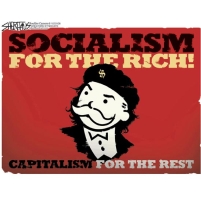

(graphic: John Sherifius)

(graphic: John Sherifius)

Thanks to the Federal Reserve’s generous lending during the 2007-2009 financial crisis, banks that were teetering and at risk of collapsing wound up making billions of dollars in profits, according to Bloomberg Markets magazine.

After combing through 29,000 pages of Fed documents released to Bloomberg by court order, the publication determined that banks earned about $13 billion in income by taking advantage of the Fed’s below-market rates. These loans were made without informing the public or Congress of which institutions were borrowing heavily to stave off disaster.

“While Fed officials say that almost all of the loans were repaid and there have been no losses, details suggest taxpayers paid a price beyond dollars as the secret funding helped preserve a broken status quo and enabled the biggest banks to grow even bigger,” the magazine reported.

The $13 billion in profits were a result of the banks being allowed to reinvest some of the $7.77 trillion in total assistance provided by the Fed to rescue the financial system. Bloomberg estimates that Citigroup accounted for $1.8 billion in profits from the loans, Bank of America $1.5 billion, Royal Bank of Scotland $1.2 billion, Wells Fargo $878 million and Barclay’s $641 million.

-Noel Brinkerhoff

Secret Fed Loans Gave Banks $13 Billion (by Bob Ivry, Bradley Keoun and Phil Kuntz, Bloomberg Markets Magazine)

Federal Reserve Secretly Loaned Wall Street Elite more than $1 Trillion (by Noel Brinkerhoff, AllGov)

Federal Reserve Gave Big Banks Enormous Secret Loans at Ridiculous Rates (by David Wallechinsky and Noel Brinkerhoff, AllGov)

Federal Reserve Finally Forced to Reveal What it Did with $3.3 Trillion (by David Wallechinsky and Noel Brinkerhoff, AllGov)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Can Biden Murder Trump and Get Away With it?

- Electoral Advice for the Democratic and Republican Parties

- U.S. Ambassador to Greece: Who is George Tsunis?

- Henry Kissinger: A Pre-Obituary

- U.S. Ambassador to Belize: Who is Michelle Kwan?

Comments