For the Bottom 90% of Americans, Financial Security is Slipping Away

(graphic: Steve Straehley, AllGov)

(graphic: Steve Straehley, AllGov)

No matter how you look at it, the economic picture for most of America is not good.

From too much debt to not enough savings to shrinking incomes, the vast majority of Americans are confronted with erosion of their financial security.

A new economic study (pdf) from the National Bureau of Economic Research paints a bleak outlook for 90% of the country. This great mass once enjoyed a growing share of the nation’s wealth from before the Great Depression until the 1980s, according to researchers Emmanuel Saez and Gabriel Zucman . The share of the wealth for that group peaked at 35% in the mid-1980s. By 2012, that share had dropped to 23%.

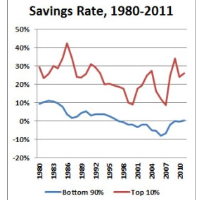

Saddled with growing amounts of mortgage, consumer credit and student debt, the 90% has had little in the way of extra money to put into savings, Saez and Zucman wrote. In fact, the savings rate by those in the lower 90% is about zero. By comparison, the top 1% of families put aside about 35% of their income. The authors say that income inequality will increase as long as the middle-class savings rate remains low.

Another report, from the liberal Center for American Progress, offered up another double whammy of fiscal troubles for Americans: declining income and growing expenses. It reported that the median income of all families dropped 8% from 2000 to 2012.

Meanwhile, the costs of sending kids to college and paying for health care and child care have soared. Higher education expenses have represented the biggest increase, jumping 62% from 2000 to 2012. Health care and child care went up 21% and 24%, respectively.

-Noel Brinkerhoff

To Learn More:

Exploding Wealth Inequality in the United States (by Emmanuel Saez and Gabriel Zucman, Washington Center for Equitable Growth)

Wealth Inequality in the United States Since 1913: Evidence from Capitalized Income Tax Data (by Emmanuel Saez and Gabriel Zucman, National Bureau of Economic Research) (pdf)

The Middle-Class Squeeze (Center for American Progress)

U.S. Income Inequality Reaches Record Extreme (by Noel Brinkerhoff, AllGov)

Upset about the Richest 1%? The Top .000003% Own $25 Trillion (by David Wallechinsky and Noel Brinkerhoff, AllGov)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump Orders ICE and Border Patrol to Kill More Protestors

- Trump Renames National Football League National Trump League

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

Comments