Dangers Seen in Use of One-Touch Cell Phone Mortgage App

(photo: YouTube)

(photo: YouTube)

By Neil Irwin, New York Times

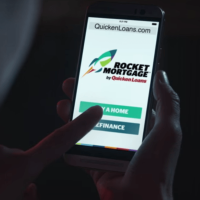

To people with fresh memories of the housing collapse, the most disturbing advertisement during the Super Bowl Sunday wasn’t the one featuring a creepy “PuppyMonkeyBaby” climbing all over a Mountain Dew drinker. Rather, it was the one for the new Quicken Loans “Rocket Mortgage,” which aims to make it easier to get a mortgage using a mobile device.

The ad raises profound, and problematic, questions of what the United States’ growth strategy should look like, even if the intent was only to get people to use a mortgage app. In short: We now know how flawed the mid-2000s growth strategy, built on soaring consumer debt, really was. But we haven’t found any great ideas for how to replace it.

The Quicken Loans ad argued that more people getting mortgages more easily — with the push of a button on a phone while sitting at a show, for example — would set off a chain reaction leading to purchases of furniture and household goods and then more jobs for people who make those goods. A “tidal wave of ownership floods the country with new homeowners who now must own other things,” the narrator said. “And isn’t that the power of America itself?”

The hackles this raised among the economic commentariat was instant. For a while during the Super Bowl, certain segments of Twitter were dominated not by talk of Peyton Manning and Cam Newton, but by snark. “Rocket Mortgage: Let’s do the financial crisis again, but with apps!” tweeted Dave Weigel of The Washington Post.

The Consumer Financial Protection Bureau offered its own timely reminder that people taking out a mortgage should take their time and ask lots of questions. And by Monday more considered criticism and defense of the ad had aired.

Quicken Loans’ defense of the commercial is strongest on this point: Its product is about making the process of applying for a loan easier, not about lowering the standards for who can get a loan and on what terms. “It’s a far different world today than in 2006 or 2007,” said Jay Farner, president of Quicken Loans, in an interview Monday.

The wave of foreclosures starting in 2007 that dragged the economy into recession and triggered a global financial crisis was driven in large part by a collapse in underwriting standards. Lenders offered mortgages to people with wildly inadequate incomes or down payments or documentation. Lending standards are much tighter now, and the new mobile app does nothing to change that.

“For folks that were well qualified but weren’t moving forward with a purchase or a refinance, we asked why,” Farner said. “The ad that was created speaks to the information we received from them.”

They found that some people who might save, say, $150 a month by refinancing, or who could afford a home for less than their rent, were reluctant to do so because the paperwork hassles seemed so daunting.

The company’s solution — especially as it is portrayed in the commercial — does have problems. The commercial portrays taking out a home loan using the app as being almost a casual thing to do.

Reducing paperwork and bureaucratic hurdles to a mortgage are desirable in isolation; the home-buying process is laden with hidden fees and conflicts of interest that can add thousands of dollars to the price of a home purchase.

But the Quicken Loans ad goes a step further, with the narrator asking what would happen if the Internet “did for mortgages what the Internet did for buying music, plane tickets and shoes,” then showing a woman getting a home mortgage with the press of a button on her phone.

If taken too literally, this could get people in trouble. A home mortgage is the biggest financial obligation most people will take on. If you buy the wrong music, plane ticket or shoes, it’s probably not a crippling financial burden, where the wrong mortgage can be.

So to the degree Quicken Loans is getting rid of some unnecessary paperwork in the mortgage process, it’s useful innovation. To the degree that it is enabling people to enter a major financial obligation without thinking it through properly, it could be dangerous. It’s a subtle distinction, but an important one, and the ad isn’t terribly careful about making clear the product is about the former, not the latter.

Then there’s the broader theory of the economy embedded in the Quicken Loans ad: that easier-to-obtain mortgage loans will spur new spending, which in turn will spur more people to get houses and so on in a virtuous circle.

As an economic strategy, it should sound familiar. It is what the United States experienced from the 1980s through 2007, and arguably throughout the entire post-War period.

The homeownership rate has plummeted since hitting a high in 2004, and if it rose, there would surely be knock-on effects for sales of other goods, such as the sectional couches with hand-lathed wooden legs portrayed in the Quicken Loans ad.

The problem is, this strategy worked best — and the homeownership rate reached its highest point — when it was all fueled by a boom in consumer indebtedness that left millions of people financially vulnerable when the economy went south in 2008.

It’s possible for an economy to be driven by a rise in homeownership and consumer spending without a debt run-up. That’s more or less what happened from the end of World War II until 1980 or so. Household formation — the process by which people set up their homes, often as they become young adults and move away from home — really has been depressed since the housing bust. The economy would benefit if that reverses.

“We’re trying to say that done the right way, home buying can be beneficial,” Farner said. “We’re not trying to tell people they should go run up debt, but good responsible homeowners do make investments in furniture, and that creates jobs and opportunity for all.”

There’s nothing inherently wrong with any of that. Responsible use of debt can be an important way for people to build a stable future. But given how badly it ended last time, anyone who lived through the housing bust can be forgiven for being worried when an advertisement for a mortgage app puts borrowed money at the center of an economic strategy and says that’s “the power of America itself.”

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump Orders ICE and Border Patrol to Kill More Protestors

- Trump Renames National Football League National Trump League

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

Comments